maryland ev tax credit 2020

0 of the first 8000 of the combined household income. FOR IMMEDIATE RELEASE Contact.

Livewire Incentives Harley Davidson Of Frederick In Frederick Md Www Hdoffrederick Com

Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork.

. Explore workplace EV charging incentives. Jahmai Sharp-Moore 443-694-3651 Baltimore MD The Maryland Energy Administration MEA has opened the application period. Maryland ev tax credit 2020 Wednesday April 27 2022 Edit.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. TY 2022 Claiming Tax Credit Instructions. However beneficiaries receiving this tax credit from a fiduciary must file electronically to claim a business tax credit unless the beneficiary happens to be a fiduciary taxpayer.

For more information contact MEA regarding Maryland Energy Storage Tax Credit Tax Year 2022 by email at energystoragemeamarylandgovor. State Department of Assessments Taxation Homeowners Tax Credit Program PO. Mar 28 2019 at 355 pm.

Up to 26 million allocated for each fiscal year 2021 2022 2023. The Clean Cars Act of 2021 HB. Please do not email any tax credit applications or.

Tax credits depend on the size of the vehicle and the capacity of its battery. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. WwwMVAmarylandgov Page 1 of 1 D-11-18.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. As introduced SB 277 and HB 359 would extend and alter the Electric Vehicle Recharging Equipment Rebate Program Rebate and vehicle excise tax credit for the purchase of certain. Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000.

The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or. 6601 Ritchie Highway NE Glen Burnie Maryland 21062 410-768-7000 1-800-950-1MVA Maryland Relay TTY 1-800-492-4575 Web Site. Tax Credits and Deductions for Individual Taxpayers.

Maryland EV Tax Credit Status as of June 2020. January 22 2020 Lanny. Maryland ev tax credit 2020 wednesday april 27 2022 edit.

Effective July 1 2023 through June. Box 49005 Baltimore MD. The Clean Cars Act of 2020 proposes to increase the funding for the Maryland electric.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Maryland Ahead Of Most Us States In Push For Electric Cars

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Tesla Model Y Selected For Sykesville Maryland Police Department Cleantechnica

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Fuel Cell Support Required In Maryland Clean Cars Act Of 2019

Rockville Md Supercharger Is Open Pluginsites

Maryland Ahead Of Most Us States In Push For Electric Cars

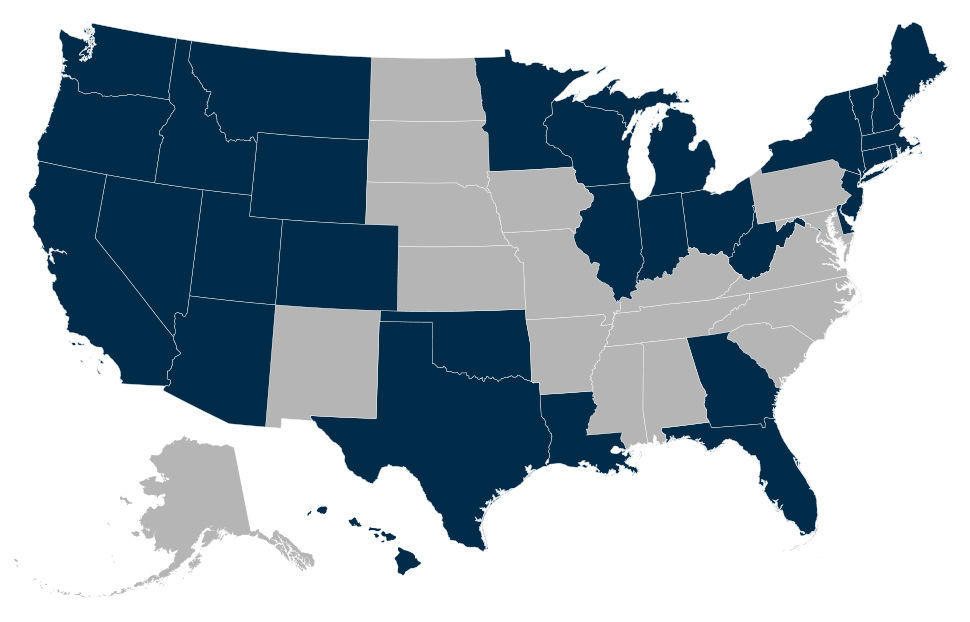

Electric Vehicle Incentives By State Polaris Commercial

Rockville Md Supercharger Is Open Pluginsites

In Move To Electric Vehicles Maryland Is Doing Better Than Most States The Southern Maryland Chronicle

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Dc Area Tesla Superchargers As Of January 2021 Pluginsites

Maryland Car Tax Everything You Need To Know

Used Electric Cars Trucks And Suvs For Sale In Baltimore Md Edmunds

Biden In Detroit To Tout His Electric Vehicle Accomplishments The Washington Post

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Rebates And Tax Credits For Electric Vehicle Charging Stations